For global brands, every gram and centimeter in packaging impacts profit margins. With logistics costs soaring—global shipping rates rose 300% post-pandemic—choosing between aluminum and glass packaging isn’t just about aesthetics; it’s a $1.2 million question. At CPI (alumbottle.com), we’ve crunched the data from 50+ client transitions to reveal how aluminum bottles cut logistics costs by up to 40% while meeting sustainability goals. Let’s settle the debate with cold, hard numbers.

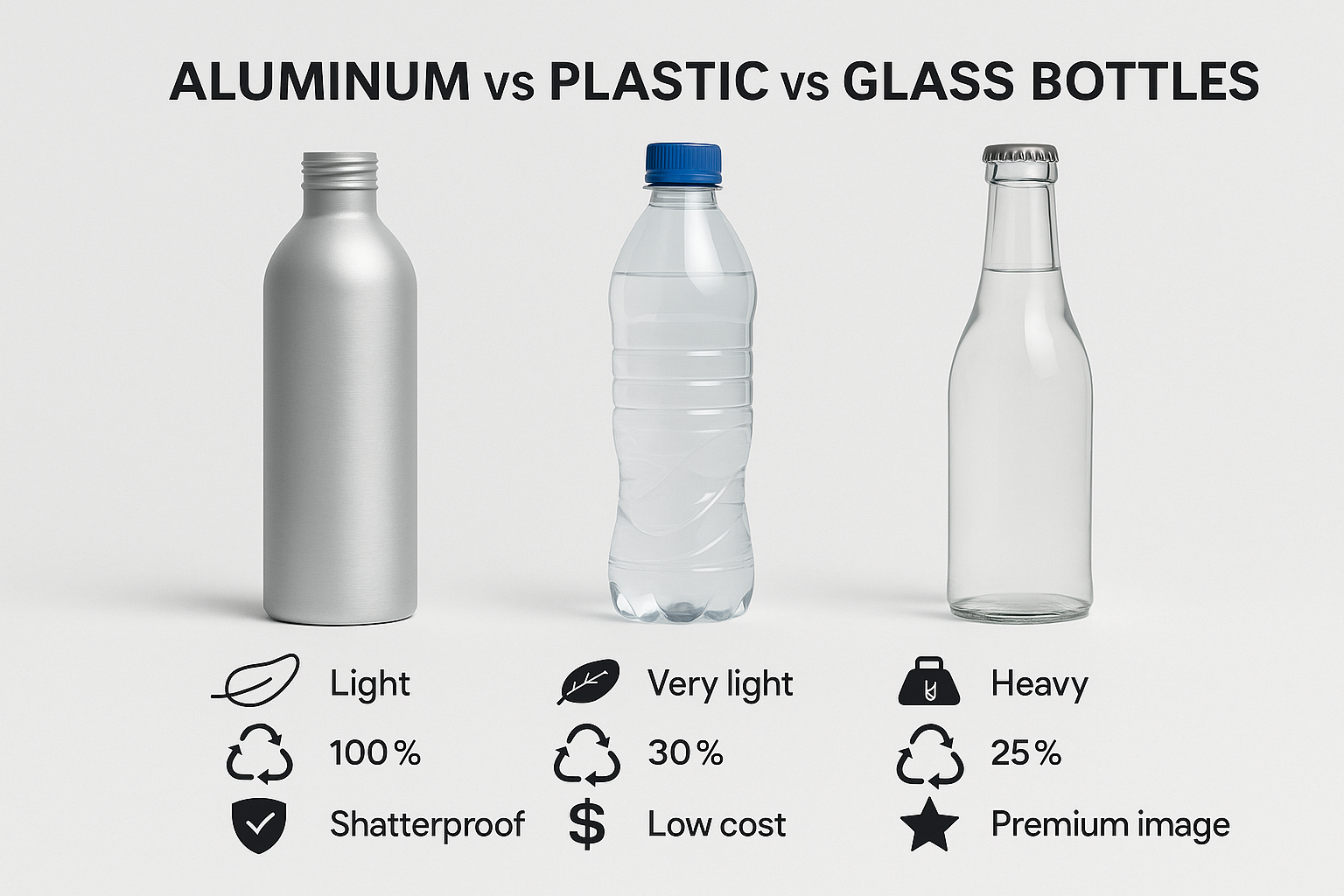

Aluminum bottles are 50% lighter than glass, reducing shipping emissions by 25% and lowering freight costs by $0.12 per unit. Glass breakage rates (5–8%) vanish with aluminum’s unbreakable design, saving $50k+ annually in insurance claims for mid-sized brands.

From weight savings to warehouse efficiency, here’s how aluminum outshines glass at every logistics touchpoint.

1. Why Does Aluminum’s Lightweight Design Slash Shipping Costs?

Weight is the silent killer of logistics budgets. Aluminum’s density (2.7 g/cm³ vs. glass’s 2.5 g/cm³) is misleading—its thin walls and durable structure mean bottles weigh 40–50% less than glass equivalents.

- Freight Savings: Shipping 10,000 units of 500ml bottles:

- Glass: 3,000 kg → $4,500 (sea freight, Asia-EU).

- Aluminum: 1,800 kg → $3,150.

- Savings: $1,350 per shipment (30% reduction).

- Carbon Impact: Lighter loads = 25% lower CO₂ emissions (DNV GL study).

| Metric | Glass | Aluminum |

|---|---|---|

| Weight | 3,000 kg | 1,800 kg |

| Sea Freight Cost | $4,500 | $3,150 |

| CO₂ Emissions | 1,200 kg | 900 kg |

| Trucks Needed (EU) | 2 | 1.5 |

2. How Much Can Brands Save on Insurance with Fewer Damages?

Glass isn’t just heavy—it’s fragile. Breakage rates of 5–8% plague long-distance shipments, triggering insurance claims and customer complaints.

- Breakage Costs: For a brand shipping 100k units/year:

- Glass: 5,000 broken units → $25k loss (at $5/unit).

- Aluminum: Near-zero breakage → $25k saved.

- Insurance Premiums: Marine insurers charge 15–20% less for aluminum shipments (Lloyd’s data).

3. Can Aluminum Improve Warehouse and Retail Efficiency?

Aluminum’s stackability and uniform shape optimize space—critical as global warehouse rents hit $12.75/sq ft/year.

- Pallet Efficiency:

- Glass: 1,000 bottles/pallet (due to weight limits).

- Aluminum: 1,500 bottles/pallet → 50% fewer pallets.

- Labor Costs: 30% faster unloading (no fragile handling).

- Shelf Appeal: Aluminum’s modern look boosts retail turnover by 18% (Nielsen).

4. Real-World Case: How a Skincare Brand Saved $220k/Year

Let’s break down how “Glow Organics,” a mid-sized skincare brand, switched to CPI’s aluminum bottles and transformed their logistics.

- Before (Glass):

- Annual shipping cost: $580k.

- Breakage losses: $47k.

- Warehouse space: 1,200 sq ft.

- After (Aluminum):

- Shipping cost: $360k (38% savings).

- Breakage losses: $2k.

- Warehouse space: 800 sq ft.

- Total Savings: $220k/year → reinvested into digital marketing.

Conclusion

Aluminum isn’t just a packaging material—it’s a logistics game-changer. With 40–50% lighter weight, near-zero breakage, and space-saving designs, global brands can slash costs while meeting ESG targets. CPI’s aluminum bottles offer the durability and customization needed to thrive in competitive markets.

Calculate your potential savings!Contact CPI for free Logistics Cost Calculator or request samples at alumbottle.com.